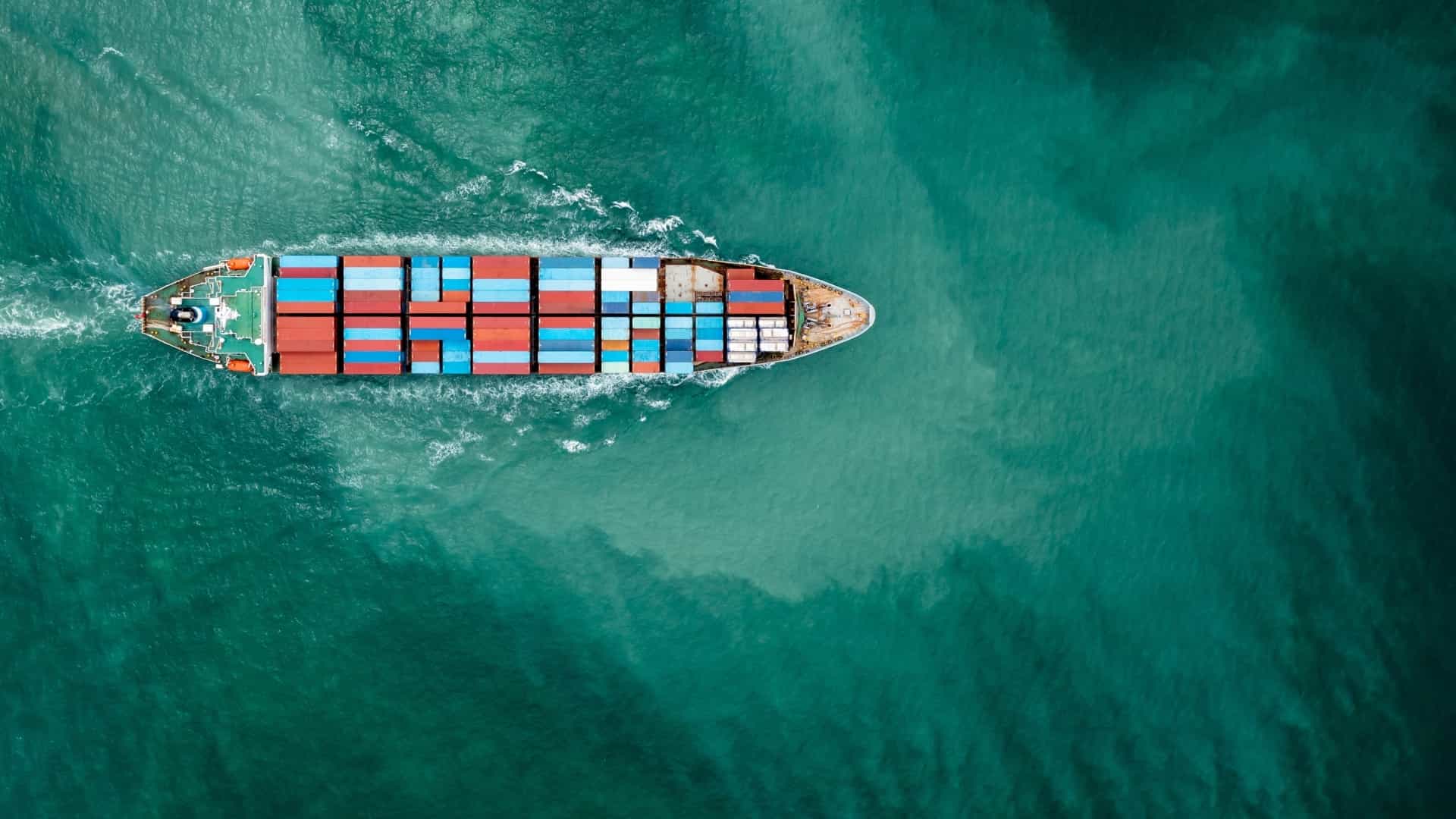

Transportation Insurance Tailored to Your Business

Worldwide Protection with Comprehensive Transportation Insurance

The transportation insurance offered by Breffka & Hehnke provides a strong safety net, protecting your business from unforeseen risks during shipping and storage. In a globalized and interconnected world where goods are transported across continents and oceans every day, reliable protection is essential.

Whether you require marine cargo insurance to cover your products on land, sea, or in the air, freight insurance specifically for forwarding companies, logistics insurance for your entire supply chain, or warehouse insurance for goods stored in warehouses—the right insurance policy can make the difference between smooth operations and significant financial losses.

At Breffka & Hehnke, we understand the challenges that come with transporting and storing goods. With our experience and deep expertise in transportation insurance, we help you develop the ideal coverage strategy tailored to your company’s needs.

Discover how you can minimize risks and run your business securely and efficiently.

Our team at Breffka & Hehnke is here to advise you personally and help you find a customized transportation insurance solution that offers the best protection for your business.

Cargo Insurance plays a pivotal role for businesses involved in transporting or shipping goods and merchandise. It provides protection for these goods during transit – whether by land, sea, or air.

This type of insurance covers unforeseen damages or losses that can occur during transport. This includes damage, theft, or even the complete loss of a shipment due to various circumstances such as accidents or acts of God.

It's crucial for businesses to carefully review the scope and terms of the insurance coverage and tailor it to the specific requirements of their business operations.

For all companies that trade, produce, or ship goods, Cargo Insurance is an essential component to safeguard against financial risks and ensure the security of the supply chain.

The Freight Forwarder's/Carriers’ Liability Insurance is a specialized form of transport insurance and is among the most important insurances for companies that undertake or carry out the transportation of goods. It protects freight forwarders, warehouse keepers, and carriers against liability claims arising from damages to transported/stored goods.

Typically, the insurance covers damages caused by accidents, theft, loss, or errors by personnel. The exact scope of coverage may vary depending on the provider and selected policy.

According to the German Commercial Code (HGB), freight forwarders, warehouse keepers, and carriers are liable for damages to the transported/stored goods. This liability can have significant financial consequences in many cases. The Freight Forwarder's, Warehouse Keeper's/Transport Liability Insurance covers the statutory liability of the freight forwarder/warehouse keeper/carrier for lost or damaged goods, thus protecting against financial risks.

For companies in the transportation industry, Freight Forwarder's, Warehouse Keeper's/Transport Liability Insurance is therefore essential to safeguard against potentially high liability claims.

Trade Show and Exhibition Insurance is an indispensable safeguard for businesses and exhibitors presenting their products or services at fairs, exhibitions, or events. It provides coverage against a wide array of potential risks that can occur at such gatherings.

This insurance typically covers damages or losses to exhibits, booths, or technical equipment. This can range from damage caused by visitors, employees, or other exhibitors to theft and unforeseen events like fires or water damage.

It's important to carefully tailor the insurance coverage to meet the individual needs and the nature of the presented products or services.

For businesses that regularly participate in trade shows or exhibitions, Trade Show and Exhibition Insurance is an essential investment. It minimizes financial risks and allows exhibitors to fully concentrate on the successful presentation of their company.

As a charterer of a vessel, you are exposed to various liability risks – for damages to the ship, to third-party cargo, or from other claims such as environmental pollution, wreck removal, personal injury, etc.

Therefore, Charterers Liability Insurance is indispensable to cover these risks and manage claims arising from chartering.

Based on your individual requirements and risks, we design a tailored insurance package for you, providing robust protection against the complex challenges of chartering a vessel.

Protect your valuables—such as jewelry, cash, precious metals, and securities—with reliable coverage. Valuables insurance safeguards your company against loss, theft, damage, and other unforeseen risks, whether you transport items yourself or hire a logistics provider. Learn more about our tailored insurance solutions and get personalized advice.

Art and Gallery Insurance provides customized protection for artworks and valuable items, whether they are paintings, sculptures, or other art objects. In an industry where each piece often represents invaluable emotional and monetary value, such insurance is essential.

This insurance covers a wide range of risks: from theft and damage to loss during transportation. Specifically designed for galleries, museums, or private collectors, it offers protection for artworks that are exhibited, stored, or in transit.

The volatile nature of the art market and the uniqueness of each artwork necessitate special insurance coverage. Art and Gallery Insurance ensures that in the event of an unforeseen incident, the financial loss is minimized.

For gallery owners, museum operators, and private art collectors, this type of insurance is an indispensable part of their asset protection. It provides security in a world where art is viewed not only as an aesthetic but also as an investment.

Marine Underwriting and Risk Prevention

We offer customized insurance solutions with extended coverage that goes far beyond standard market offerings. Our general policies are based on a specially developed set of conditions, which is regularly updated to meet the latest requirements.

In addition to providing optimal insurance protection, we place great emphasis on loss prevention and risk mitigation to identify and minimize potential risks at an early stage.

Thanks to our underwriting authority, we handle cargo claims quickly and efficiently—with minimal red tape—and initiate recourse actions against liable third parties when necessary.

FAQs – Transportation Insurance

Transportation insurance protects businesses against financial loss caused by damage, loss, or theft of goods during transit. It applies to goods transported by road, sea (including inland and ocean transport), or air. This type of insurance ensures your cargo is covered from dispatch to delivery—essential for businesses involved in national and international trade.

Depending on your business needs and risk profile, different transportation insurance policies are available:

- Marine Cargo Insurance:

Comprehensive protection for goods transported by land, sea, or air. - Own-Account Transit Insurance:

Designed for companies that transport their own goods using company-owned vehicles. - Exhibition & Trade Fair Insurance:

Covers goods and exhibits while being displayed, stored, or transported for events. - Warehouse Insurance:

Protects goods stored in warehouses from fire, theft, and natural disasters. - Carrier’s Liability Insurance:

Provides legal liability coverage for freight forwarders, carriers, and warehouse operators in case of damage or loss to third-party goods.

Transportation insurance protects against a wide range of risks that can occur during the movement of goods, including:

- Accidents involving trucks, ships, airplanes, or trains

- Theft and robbery at any stage of transport

- Fire, whether in transit or while temporarily stored

- Water damage, e.g., due to sea spray, flooding, or condensation

- Force majeure events such as earthquakes, storms, or floods

- Loading and unloading damage caused during handling operations

This insurance is essential for manufacturers, exporters, importers, wholesalers, and logistics companies that ship goods regularly. It helps avoid serious financial setbacks due to unexpected incidents.

Choosing the right insurance depends on several key factors:

- Type of goods and transport method:

- Valuable or fragile items (e.g. electronics, jewelry) require specific coverage.

- Standard commercial goods may be covered with a basic transport policy.

- Shipping frequency:

- Businesses with regular shipments benefit from annual coverage.

- Infrequent shippers may prefer single-trip policies.

- Additional risks:

- Risks such as war, strike, seizure, or storage during transit can be added through policy extensions.